Real Estate vs Stock Market: Would You Rather Earn a 0.8% or 6% Real Return?

- Blair Hoover

- Oct 24, 2025

- 5 min read

We inherit our understandings of the world from our parents... For the past, well, forever, buying property has been the number one way of building and maintaining wealth. Here in the UAE, we’ve seen the desert slowly get fenced off, mirroring a trend across civilization for ages. Many of our parents and grandparents built their wealth on property (or wish they had). Who doesn't want to cosplay as a Scottish Laird, or Lady? But is it true? Is property actually the best way to build wealth today?

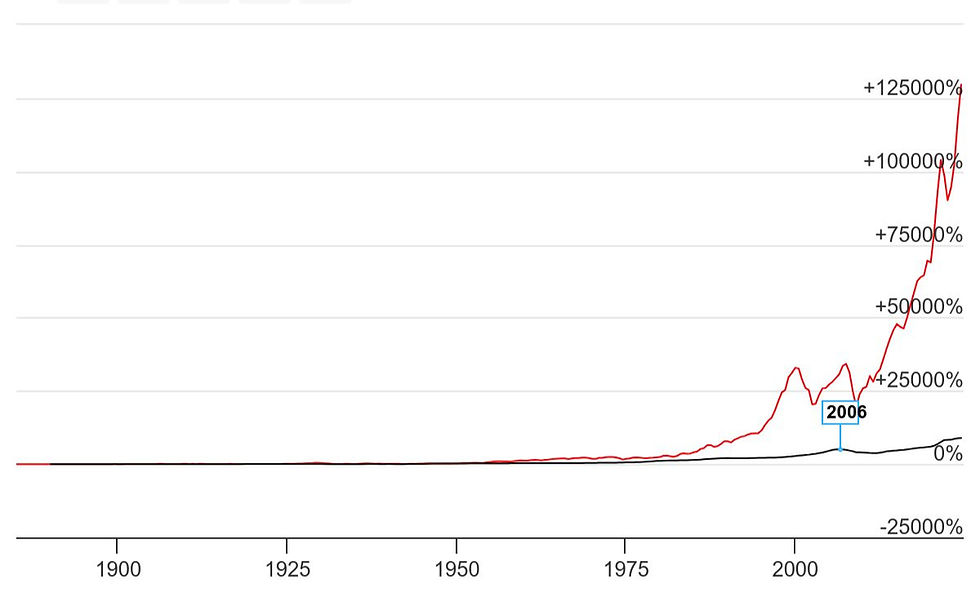

0.8% Real Estate Return vs 6% Stock Market Return

Below is a graph of the US National Case Shiller Home Price Data. This index adjusts home prices to inflation so you can see the "real" prices. You can clearly see that real home prices in the US have doubled since 1890, which comes out to an annualized inflation adjusted return of about 0.8%. Including long periods where home values stayed roughly the same or even lost value.

Once you adjust for inflation, as we've done in this graph, the returns don't look great. Doubling is wonderful, but divided 140 years? That's how you get a 0.8% return. 0.8% per year isn't very much for an investment. In general, property keeps pace with inflation, but not without volatility. If you want to make money off of property, you really need rental income. The capital appreciation alone just isn't going to get you there.

This data is averages, so of course there are some people doing much better than this on capital appreciation, but then there are also others doing much worse. That's how averages work. Even so, these numbers don't look great.

Okay, so what's the alternative? Index investing of course! I'm not talking about buying NVIDIA or any other hot stock pick, I'm talking about buying a whole market tracking index fund. When we crunch numbers on index funds, we almost always use the S&P 500 because it's the oldest index and we can find the data going back into the 1800s. That said, I generally suggest that people invest in a whole world tracking fund instead of just the S&P because the added diversification smooths out some of the volatility and will likely earn better returns over the long run.

From this graph you can see that since about 1980 the S&P has taken off. In fact, if you compare the housing index to the S&P as a ratio, you'll see that there's only one point in time where property in the US held more value than the S&P, that was the summer of 1932, deep into the Great Depression. The average annualized inflation adjusted return of index investing is around 6% , compared to the 0.8% for property. However, you can make money in property, you just need to make income from it.

Landlords Make Money

If you want to make money on property, you're going to need to be renting it out. I am no expert on rental property, but Paula Pant of Afford Anything is. She has many informative posts about real estate investing, and if you want to go this route you really should read this post to see what you're getting into. However, if you just want a quick calculation, you can use the 1% rule to decide if a given property is worth investing in:

Monthly rent > 1% of total purchase price

So if you are looking at buying a 1.25 million AED apartment, could you reasonably expect to rent it out for 12,500 AED a month? (150,000 AED/year)

When you look at the math this way, there are very few properties in the UAE (or anywhere!) that meet this standard. When it was possible to buy a 2 bedroom flat in Water's Edge for 1.25 million, these flats were renting out for around 80,000 AED/year. Today these same apartments are renting for around 120,000 AED/year, still well off of that 150,000 annual rent target, but if you want to buy one now they are selling form an even higher 1.5-2 million depending on the view.

The best deal I could find in my simple search today was a 1 bedroom in al reef coming in at 0.8% which still fails the 1% rule, though it's closer than the 2 bedrooms I looked at in Al Reef, Water's Edge, and Sun Tower on Reem. I am sure that there are some good deals on property to be had in the UAE, but it's not most of them. You really do have to run your numbers. If you find a property for sale currently in the UAE that passes the 1% rule then please let me know in the comments and I'll include it in an update.

Okay, so what if you already have a property? How can you compare its performance to the market?

How to Evaluate the Property You Already Own

The most straightforward way is to calculate your property's opportunity cost. This means calculating the growth you missed by having your capital tied up in the property instead of in a diversified index fund.

Calculate Total Costs: Determine how much money you have actually paid into the property (down payment + closing costs + principal paid on the mortgage + renovations). This is not your interest rate or your remaining balance owed.

Hypothetical Index Value: Ask: If I had invested that same dollar amount in a whole world index fund on the same day, what would that investment be worth now? Google Finance ETF graphs can help you figure it out.

The Comparison: Compare the capital appreciation of your property (current market value) plus the net rental income (if applicable) divided by the number of years you've owned it against the annualized return from the index fund. (You don't need to adjust for inflation here since you're comparing two outcomes subject to the same rate of inflation)

Often, when you factor in the illiquidity, the costs of maintenance and fees, and the headache of being a landlord, property dramatically underperforms a simple, diversified index fund.

The Takeaway

There is absolutely nothing wrong with buying a primary residence for lifestyle, stability, or community. Being a landlord can create immediate cashflow and can be a good business. Sometimes an investment property can serve as a failsafe future home in a tight market (London? Paris?). But when you look at the real returns of real estate vs the stock market and you are focused on pure, long-term wealth creation, the data is clear:

The easiest path to wealth is diversified, liquid, and boring.

The path your parents took was right for their time and context. But for us, today, the evidence overwhelmingly points to low-cost, whole-market index investing as the most efficient and least risky engine for building wealth.

Don't let historical assumptions dictate your future. Run your own numbers.

Comments